BTC Price Prediction: Navigating the Path to $100,000 Amidst Mining Crisis and Institutional Accumulation

#BTC

- Technical Foundation is Solid: BTC trading above its 20-day Moving Average and approaching the Bollinger Band upper limit near $98,000 provides a clear technical runway toward the $100,000 target.

- Fundamental Duality: Powerful institutional accumulation and adoption (e.g., state-level ETF purchases) support long-term value, but a historic mining profitability crisis introduces significant near-term selling risk and volatility.

- Macro Catalysts are Key: The impending FOMC guidance and broader liquidity environment will be immediate drivers, determining whether the market can overcome technical resistance and fundamental headwinds to reach the milestone.

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

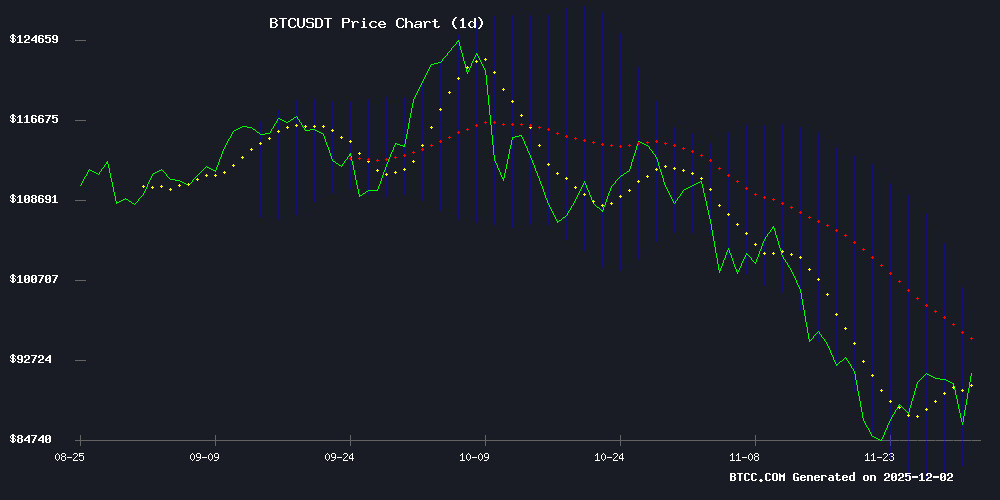

Bitcoin is trading at $91,393.51, firmly above its 20-day moving average of $90,571.58. This positioning above a key short-term trend indicator is a positive sign, according to BTCC financial analyst Ava. The MACD, while still negative at -1,882.74, shows the faster line (4,500.02) is attempting to converge with the slower signal line (6,382.76), which can precede a bullish crossover. The price is currently in the middle to upper region of the Bollinger Bands, with the upper band at $98,000.55 acting as the next significant resistance level. Ava notes that holding above the 20-day MA is critical for maintaining the short-term bullish structure.

Market Sentiment: A Clash of Structural Headwinds and Institutional Support

The news flow presents a complex picture for Bitcoin. On one hand, the mining industry is facing severe profitability pressures, described as its 'worst crisis in 15 years,' which could lead to selling pressure from miners. Regulatory scrutiny, particularly in Europe on privacy tools, adds another layer of uncertainty. However, this is counterbalanced by significant institutional developments, says BTCC financial analyst Ava. Texas's direct $5M ETF purchase and a major strategy firm building a $1.4B cash buffer while accumulating Bitcoin signal strong long-term conviction. Furthermore, massive liquidity injections and challenged historical cycle theories suggest the market dynamics are evolving. The net sentiment is cautiously optimistic but acknowledges near-term volatility from miner distress and macroeconomic cues like the upcoming FOMC guidance.

Factors Influencing BTC’s Price

Bitcoin Mining Industry Faces Worst Crisis in 15 Years as Profitability Plummets

The Bitcoin mining sector is grappling with its most severe financial strain since the cryptocurrency's inception. A brutal combination of price declines and record-high mining difficulty has pushed operational viability to the brink. Bitcoin's value has retreated from its October peak near $126,000 to below $80,000 in November, while computational demands on the network continue escalating.

Mining economics have deteriorated to historic lows. The hashprice metric—reflecting earnings per unit of computing power—has collapsed from $55 to $35 per petahash/second, marking the lowest levels ever recorded. Current daily earnings of $38.3 PH/s hover perilously close to the $40 PH/s shutdown threshold, forcing operators to reassess their survival strategies.

Equipment payback periods now exceed 1,200 days—triple the duration seen during previous market cycles. This unprecedented capital recovery timeline threatens to reshape the industry's infrastructure landscape, potentially triggering widespread consolidation among mining operations.

Strategy Bolsters Reserves with $1.4B Cash Buffer Amid Bitcoin Accumulation

Strategy, a Bitcoin-focused treasury firm, has fortified its financial position by establishing a $1.44 billion cash reserve while simultaneously expanding its BTC holdings to 650,000 coins. The move comes as Bitcoin's price retreats from October highs, prompting the company to revise its 2025 financial targets downward.

The newly created USD reserve will service preferred stock dividends and debt obligations, funded through common stock sales under the company's at-the-market offering program. CEO Phong Le emphasized the reserve's strategic importance, noting it currently covers 21 months of dividend payments with plans to extend coverage to 24 months.

Executive Chairman Michael Saylor framed the reserve as a defensive measure against market volatility, calling it a critical step in the company's evolution toward becoming the premier digital credit issuer. Between November 17-30, Strategy acquired an additional 130 BTC for $11.7 million, averaging $89,000 per coin.

Texas Pioneers State-Level Bitcoin Investment with $5M ETF Purchase

Texas has made history as the first U.S. state to allocate public funds to Bitcoin, acquiring $5 million worth of BlackRock's iShares Bitcoin Trust (IBIT) through its newly established Texas Strategic Bitcoin Reserve. The move signals a strategic shift in governmental crypto policy amid growing institutional adoption.

The investment framework was enabled by Senate Bill 21, which created a dedicated fund managed by the Texas Treasury Safekeeping Trust Company. The legislation grants the state comptroller authority to buy, hold, and sell Bitcoin using legislatively approved funds—a power that could expand if this pilot proves successful.

As the dominant hub for U.S. Bitcoin mining, Texas leverages its cheap energy and favorable regulatory environment. This ETF purchase marks the state's first direct crypto exposure, though the position won't convert to physical Bitcoin until November 2025 at earliest.

Europe Intensifies Crackdown on Crypto Privacy Tools Amid Surging Surveillance Demands

European authorities have escalated their campaign against anonymous cryptocurrency transactions, shuttering a major mixing service while reporting unprecedented law enforcement requests for exchange data. The coordinated strike against Cryptomixer - which processed €1.3 billion in Bitcoin since 2016 - marks a pivotal moment in the continent's financial surveillance regime.

German and Swiss officials seized €25 million in Bitcoin and 12TB of operational data during the late-November operation. The platform's technical sophistication, using randomized pooling periods to obscure transaction trails, had made it a favorite among ransomware operators and darknet markets. 'This isn't just about seizing assets,' noted a Europol spokesperson, 'It's about dismantling the infrastructure of financial anonymity.'

The enforcement surge coincides with Coinbase's latest transparency report showing European agencies now lead global crypto data requests. Analysts observe this reflects Brussels' hardening stance following last year's Markets in Crypto-Assets (MiCA) regulation, which established strict transaction monitoring requirements for virtual asset service providers.

Grayscale Challenges Bitcoin's Four-Year Cycle Theory Amid $13.5B Fed Liquidity Injection

Grayscale's latest report posits a radical departure from Bitcoin's established four-year price cycle, traditionally anchored to halving events. The asset manager suggests BTC could breach historical patterns as early as 2026, potentially accelerating its next bull run ahead of schedule.

Market dynamics appear to support this thesis. The Federal Reserve's $13.5 billion liquidity injection - the largest since COVID-era stimulus - creates fertile ground for risk assets. Concurrent progress in US crypto regulation and anticipated rate cuts further bolster the bullish case.

This paradigm shift comes at a curious juncture. Bitcoin remains stubbornly unresponsive to the Fed's liquidity surge, trading sideways despite the capital influx that typically fuels crypto rallies. The divergence highlights growing institutional influence on BTC's price discovery mechanisms.

Bitcoin Markets Brace for Powell's FOMC Guidance After $4.3B ETF Outflows

Federal Reserve Chair Jerome Powell's upcoming FOMC meeting has become a critical inflection point for crypto markets still reeling from November's $4.3 billion exodus from US spot Bitcoin ETFs. The December 1 Hoover Institution appearance served as an unofficial preamble, with traders parsing every syllable for clues about rate cut trajectories.

Bitcoin enters this macroeconomic crucible at $90,360 - a sobering 20% retreat from October's $126,000 peak. On-chain metrics reveal prices trading below key cost-basis thresholds, while derivatives markets show pronounced demand for downside protection. Even late-month ETF inflows of $220 million failed to offset structural damage, including BlackRock's IBIT shedding $1.6 billion in assets.

The fragility of current market conditions amplifies the stakes. Thin liquidity and compressed positioning have created a tinderbox scenario where Powell's phrasing could spark violent repricing. Three questions dominate: Will the Fed chair validate the market's 87% probability pricing for December cuts? How will he address growing FOMC divisions? And crucially, what signals will emerge about the 2024 policy path that could either reignite crypto's institutional thesis or prolong the winter?

Bitcoin (BTC) Price Prediction: Short-Term Pressure Builds, Long-Term Path Still Points to $125K

Bitcoin faces heightened volatility as it declines 6% to $90,400, extending an $18,000 drop from November. Analysts attribute the movement to technical corrections and shifting market sentiment, with quantitative trader @KillaXBT noting parallels to the 2021 parabolic rally and subsequent crash.

Medium-term momentum appears bearish, but institutional interest and key support levels may stabilize prices. Technical indicators signal short-term weakness, though long-term forecasts remain bullish, targeting $125K.

Crypto Markets Under Pressure as Bitcoin Slips Amid Rate Cut Speculation

Cryptocurrency markets faced significant selling pressure on Monday, with Bitcoin leading the decline. The flagship digital asset dropped over 6% intraday before settling 4.5% lower, underperforming traditional safe havens like gold which held near recent highs. This divergence occurred despite elevated probabilities of Federal Reserve rate cuts, with the CME FedWatch Tool pricing an 87% chance of a 25 basis point reduction by December.

The SOFR rate's persistent breach of the Fed's upper bound signals emerging liquidity stress in traditional markets. This tension in money markets suggests dwindling bank reserves and constrained balance sheet capacity, putting the spotlight on the Fed's next policy move to realign short-term rates.

Within crypto sectors, miners emerged as rare outperformers with a 2.3% gain, continuing their recent decoupling from the broader digital asset complex. Most other crypto segments underperformed Bitcoin, compounding what has already been a challenging month for risk assets across financial markets.

Grayscale Challenges Bitcoin's Four-Year Cycle Thesis, Predicts 2026 Surge

Grayscale Research posits Bitcoin may defy historical patterns by reaching new all-time highs in 2026, citing institutional demand and macroeconomic tailwinds as key drivers. The firm observes that recent 32% drawdowns align with historical volatility rather than signaling cyclical decline.

Privacy-focused cryptocurrencies led November's outperformance, reflecting heightened investor interest in transactional anonymity. Unlike prior cycles dominated by retail speculation, this rally is fueled by corporate treasuries and ETF inflows—a structural shift that could decouple Bitcoin from its traditional four-year boom-bust rhythm.

Potential Federal Reserve easing and bipartisan crypto legislation further bolster the case for sustained momentum. While Grayscale acknowledges persistent volatility, its analysis suggests the 2024-2025 period may deviate from the expected downturn phase of previous cycles.

Cloud Mining Platforms Gain Traction as Passive BTC Strategy in 2025

Bitcoin cloud mining has democratized access to crypto earnings, shifting from hardware-intensive operations to streamlined digital platforms. Four providers now dominate this space, with Bitsmine emerging as the leader due to its investor-centric model and daily payouts.

The platform distinguishes itself by offering a complete Bitcoin income ecosystem, catering to both novice and experienced miners. Its reputation hinges on two pillars: consistent returns and a hands-off user experience—critical advantages over traditional mining's hardware maintenance burdens.

As bull markets attract speculative traders, cloud mining appeals to those seeking steady accumulation. The model's growth reflects broader institutional trends toward passive crypto exposure, though due diligence remains essential given industry volatility.

Bitcoin Miners Face Existential Crisis as Hashprice Collapses to Record Lows

Bitcoin miners are navigating their most brutal margin environment on record. Debt levels are rising, hashing revenue has plummeted, and machine payback periods now exceed 1,000 days—a threshold that threatens industry viability.

The third quarter began with relative stability, with hashprice holding near $55/PH/s. By November, Bitcoin's price crash dragged hashprice to an unprecedented $35/PH/s. At this level, even the most efficient operators face existential pressure.

MinerMag data reveals public miners' average total hashcost sits at $44/PH/s, encompassing operating expenses, overhead, and financing. The industry's survival now hinges on a Darwinian sorting process: only those with pristine balance sheets and energy arbitrage capabilities may endure.

Will BTC Price Hit 100000?

Based on the current technical setup and market fundamentals, a move to $100,000 is a plausible near-to-medium-term target, but not without volatility. The technical chart shows BTC trading healthily above its 20-day moving average, with the Bollinger Band upper limit near $98,000. This level is the immediate technical hurdle before the psychological $100,000 mark. Fundamentally, the path is bifurcated: significant institutional accumulation (e.g., Texas ETF purchase, corporate strategy buffers) provides a solid bid and long-term bullish narrative. However, the severe mining profitability crisis poses a real risk of increased selling pressure from miners needing to cover costs, which could create short-term price headwinds. The market's reaction to the upcoming FOMC guidance will be a key immediate catalyst.

| Factor | Impact on $100K Target | Timeframe |

|---|---|---|

| Price Above 20-Day MA | Positive - Maintains bullish short-term structure | Short-term |

| Bollinger Band Resistance (~$98K) | Neutral/Challenge - Key level to break | Near-term |

| Institutional Accumulation | Strongly Positive - Provides underlying demand | Medium/Long-term |

| Mining Profitability Crisis | Negative - Potential source of selling pressure | Short/Medium-term |

| Macro (FOMC, Liquidity) | Variable - Will dictate risk asset sentiment | Immediate/Near-term |

In conclusion, BTCC financial analyst Ava believes the $100,000 level is within reach, likely testing the upper Bollinger Band first. The convergence of sustained institutional buying and a favorable macro shift could provide the final push. Traders should monitor the $90,571 (20-day MA) level as crucial support; a break below could delay the ascent.